Abandoned house worries neighbors

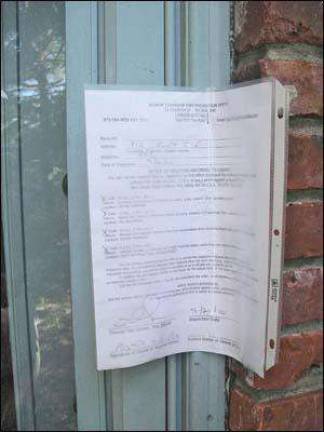

Before foreclosure, it’s a long road to losing a home, By Robin Mills Vernon The house at 412 Route 515 is vacant. It’s been several months since the next-door neighbors saw the owners of this property. And in that time, they say that cats have overrun the place; it’s gone into deep disrepair, windows have been broken, an SUV sits idle in the driveway, garbage and household possessions are piled up outside, on the deck and next to the industrial dumpster in the yard. The neighbors are concerned, not only about the animals, but about how this neglected property will affect their own property values. A notice rolled up and shoved in the handle of the door reads: “On Sept. 23, 2010 a Writ of Possession was filed for the property at #412 Route 515, Vernon with the Sussex County Sheriff’s Office, by the current owner, 375 Park Holdings LLC of Chandler, Ariz. They were the successful bidder at the sheriff’s sale on 4/26/2010.” Although 375 Park Holdings, LLC has been the owner of this property since the foreclosure sale back in April, enacting New Jersey foreclosure laws is a lengthy process. It’s not simple to take possession of a foreclosed property. The writ of possession, mentioned in the notice left at this home, is the next to last step in the eviction process on a foreclosed home. Now, the new owners or their lawyers are required to file for eviction with the sheriff’s office. Eviction proceedings can take another 30 to 90 days. Walking away Not far away, another Vernon family, unable to keep up with their mortgage payments, recently walked away from the home they’d lived in for more than 15 years. With a sheriff’s sale pending on their property for over a year, this family of eight decided to make the move to a rental property before facing a forced eviction. The three generations had lived together to ease the burden of the expenses, share the bills and juggle childcare. But it still wasn’t enough. They had weathered unemployment, health problems, no health insurance, and lastly, a very long and drawn out foreclosure. In spite of difficult economic times, they try to remain optimistic. “We might not have a lot of money, but we have each other,” said this mother of three and grandmother of two, who would prefer to remain anonymous. “Just knowing that we are all pulling together, sharing the good times and the very difficult times has made us an even closer family.” Unfortunately for them, they were not eligible for any of the mortgage relief programs available to people in distress. Their home’s loan to value ratio had increased as real estate values plunged over the past few years. The amount they owed had far exceeded the house’s market value. Add to that the interest, penalties and legal fees, and the family was in a financial morass they could not find their way out of. “It was easier to walk away than to try and catch up on a past due mortgage,” said the homeowner. “My credit was already ruined due to the default on the mortgage. Bankruptcy might be the only way for us to start over with a fresh slate.” Tough choices This local family is not alone. All over the country, families are finding themselves in a similar situation. Many factors contribute to a foreclosure: Prolonged unemployment; depreciation of a home’s value and a concurrent loss of equity; unexpected medical expenses to name the top three. Another way this Vernon family reflects what’s going on in America is that two adult generations were pooling resources to make ends meet. Multigenerational housing has been on the rise since the 1980s. Adult children are remaining at home longer or are returning home. Aging parents are moving in with their adult children to help with the household bills and to save on child care costs. The U.S. Census Bureau shows that in 2008, a record 49 million Americans shared a home with at least two adult generations; a 2.6 million increase over the previous year. Foreclosures rise Realty Trac.com shows 196 homes in default in Vernon as of this week. The site indicates the national average of foreclosed homes during August-September was about one out of every 381 homes. New Jersey fared slightly better than the national average, led by Union County, with one in every 423 housing units receiving a foreclosure filing during the month of August. Sussex County had the second highest foreclosure rate in the state with one in every 471 homes. Elsewhere in Sussex County, 139 were listed in Franklin; 131 were listed in Wantage; 126 were listed for Sparta. When a homeowner misses just one payment, this is referred to as a default on mortgage. The amount of time a lender may wait to file for default varies, but is generally after several months of missed payments. Pre-foreclosure is a result of a default on the mortgage payment. In this instance, the lender files for foreclosure. This allows the lender to sell the property to regain the amount owed on the mortgage debt. Many homeowners use this time to try to sell the property on their own or through a Realtor to avoid a foreclosure sale. On hold Much has come to light in the last few months about improper foreclosure proceedings and a freeze was put on many of them. That put some foreclosures in limbo, roiling both sellers and buyers. Bank of America, Ally Financial, JP Morgan Chase, GMAC, PNC and several other mortgage lenders have, as a result, been under scrutiny for signing off on incomplete and in some cases, inaccurate foreclosure paperwork. The latest upshot, Bank of America, after reviewing its procedures for foreclosures, announced that as of Oct. 25, it would lift its freeze.

What to do

Homeowners facing an inability to pay are best served by quick action. Those who contact their bank or mortgage lender soon may find the lender willing to adjust their interest rate or mortgage payment in an effort to help the homeowner keep paying.

The Home Affordable Modification Program (HAMP) is just one of the government sponsored plans designed to assist homeowners with mortgage modifications, so that payments can be made more affordable. For more information on HAMP, call 888-995-HOPE to speak with a HUD-approved housing counselor for free.

To find an extensive listing of the most frequently asked questions about what can be done if a homeowner is having trouble making payments, visit www.makinghomeaffordable.gov. For information on free Foreclosure Avoidance Counseling sponsored by the Deptartment of Housing and Urban Development (HUD), and Neighborworks America, and to find a listing of local HUD-approved counselors go to: twww.hud.gov/offices/hsg/sfh/hcc/fc or call 1-888-995-HOPE (4673).

Anatomy of a foreclosure

Depending on the court schedule and volume of cases, it can take nine months or more to finalize an uncontested foreclosure. This process may be delayed if the borrower contests the foreclosure, seeks a postponement or files for bankruptcy. New Jersey has one of the longest wait times for foreclosures. Serving the complaint to the defendant is one of the most time-consuming and difficult aspects of the process. The sheriff’s office has 40 days to attempt to serve the defendant. However, if the home appears abandoned, and the location of the owner unknown, the notice can be placed in a conspicuous location at the residence, showing due diligence on the part of the court. Once served, the borrower, now the defendant, has 35 days to file a response to the foreclosure complaint.

If they do not respond, a default judgment can be entered by a judge. After this, the lender/plaintiff must wait another 45 days before final judgment. At that time a writ of execution is issued and delivered to the sheriff to start the foreclosure sale process.

The sheriff is required to schedule a sale within six months of receipt of the writ. The defaulting borrower must be given at least 10 days notice before the foreclosure sale can take place. The foreclosure sale may be postponed twice by both the lender and defendant.

Most homes are sold at public auction, in the county of the property. Some are sold privately by banks as a result of a repossession.

After the sheriff’s Sale, a Writ of Possession can be issued and served within 30 days. The occupants are given 21 days to move. If they don’t, an eviction can be scheduled, which can take up to 90 more days.

Even then, the original homeowners can get a 10 day grace period from the sheriff’s sale to pay in full the back mortgage plus taxes and fees and buy back their home.