Scammers nearly collect $30,000 from Warwick resident’s bank account. Here’s how:

Be alert: It is not just emails with bad grammar anymore. There are much more elaborate and convincing online schemes to steal your money.

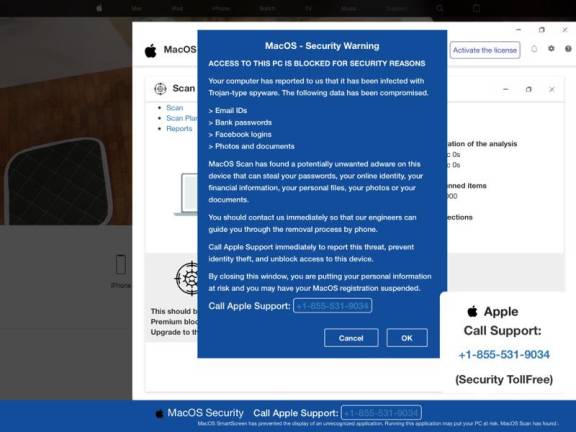

M, a retired nurse and a longtime Warwick resident, was playing solitaire on her iPad after lunch on Friday, Feb. 16, when a security warning suddenly took over her screen. The pop-up claimed that her access on the device was blocked for security reasons relating to data that had been compromised by Trojan-type spyware. It said the message was from her device’s “security team” and suggested she call a secure phone number to get technical assistance.

M (an abbreviation of her name to protect her identity) called the number on the screen. She was then told that the line was compromised. The person on the line asked her to hold and insisted that she not hang up, while he called her back.

‘We’re going to take care of this’

When he did, it came from a blocked, unknown number, leading M to believe it was a security team reaching out to her.

The person on the line told her she had been hacked by foreign operatives who had downloaded child pornography on her device. M said she felt “sick to her stomach.”

She was also told that the hackers had access to her bank account.

“He somehow knew that I had $30,000 in my account,” M recalled. “I didn’t even think to question how technical support for my device knew my balance, I was just so shaken.”

M said the person on the phone was convincing. He did not act “like a hacker,” he was sophisticated and behaved more like a customer service representative.

“Be calm, be calm,” he told her. “We’re going to take care of this.”

He kept reiterating that she needed to remain on the line while he and his team handled the situation.

Once M knew her money was at risk, though, she didn’t feel comfortable sitting by.

“I told him ‘I’m just going to go to the bank and take my money out,’” thinking that would be the best way to protect it.

“No, no, no, don’t do that,” he said. “We will walk you through how to do this.”

M added that he was very persuasive that there was a “specific way to handle this.”

A gas station in Ringwood, N.J.

Although she was not yet suspicious because she believed she was on the phone with technical support, M found herself shaking with fear.

However, she could no longer wait so M drove to the bank to withdraw her money before the supposed hackers could access it. M said she was physically trembling when she arrived at the bank.

The man who turned out to be a scam artist was still on the line. He instructed her to tell the bank teller that the money was for college.

Leaving her phone in the car with the scammer waiting on the line, she walked into the bank.

When M told the teller that she needed to withdraw $30,000 of her savings, the teller asked why she needed the money.

“College,” M said.

‘They won’t take a check?” the teller asked.

M simply replied that it was “complicated.”

The bank teller asked no further questions, completed the request, and M walked out of her bank with two envelopes full of $20,000 in cash and a cashier’s check for $10,000.

When she got back in her car, she told the man on the phone that she had the money and asked him what to do next.

He gave her an address. “It’s very close to you, it’s 1009 County Road in Ringwood, New Jersey.”

M asked if it was the location of another financial institution. “I couldn’t understand why I would I need to go somewhere else or why he would request I give my money away,” M said.

She decided to go to her daughter’s house a few minutes away.

M was now driving with him on speakerphone. He claimed this was the only way to secure her money. He also clarified that the location in Ringwood was actually a gas station where she would meet a man by the name of Patrick Ford.

“In that instant,” M said, “it was like I was plunged into cold water. I finally woke up and realized I was being scammed.”

The daughter steps in

Having already arrived at her daughter’s house and with the scammer still on the phone but muted, M described what had happened.

All the while, the scammer kept asking: “Ma’am are you still there? We’re running out of time.”

M’s daughter searched for the customer service number for Apple, which did not match the number from the notification on M’s iPad. The daughter explained that the customer service department would not have knowledge of M’s bank account balances, nor would any legitimate institution request that she withdraw her savings and hand them over to someone in a parking lot.

The daughter then turned off the mute button and said: “We are no longer going to take part in this disgusting scam. You should be ashamed of yourself,” before cursing him off the phone.

The scam artist replied: “Yes, okay, ma’am.”

‘Be alert’

From moment the alert first appeared on M’s screen to her daughter’s final choice words for the scammer, M’s ordeal had lasted 90 minutes.

“I just broke down in tears,” M said. “I felt so stupid and violated and I couldn’t believe I didn’t realize sooner but they really were so convincing.”

A few days later, M contacted the legitimate customer service department for Apple and relayed what had happened. The customer service representative told her that her device was secure since she was not asked to download anything. The rep also the department had the fraudulent phone number “on their radar.”

Though scary and embarrassing, M decided that it was important to share her story with this newspaper in an effort to heighten awareness.

“Be alert,” M said. “If you think you think this could never happen to you, think again.”